Brian McConnell

The Integral Research Center Roanoke, VA

Abstract: Presenting a background of historical context, “Toward a Sustainable Future” offers an overview in the ascendancy of neoliberal/neoconservative viewpoints constituting the world’s dominant socioeconomic ideology today. An AQAL framework is then introduced and subsequently examined as an aid to envisioning and ultimately adopting Integral approaches capable of better supporting value(s) of human relatedness. In so doing, the article’s content aspires to empower today’s leaders to pioneer practical, sustainable, transformations in community living and lifestyles.

Keywords: Arnsperger, AQAL, central banking, complementary currency, Cook, exemplar, integral ecology, integral economics, integral leadership, Lietaer, morality, neoclassical economics, neoconservatism, neoliberalism, Riba, sustainability, usury,

Introduction

Years of academic study, aided significantly by recent technical and methodological advances in research, have instilled in me an abiding appreciation for the ways in which power, wealth, and government have coalesced with each other over the last four hundred years. These patterns are all the more captivating however, when viewed as emergent dimensions of human consciousness. Consequently, tracking the cultural evolution (and utilization) of usury from its cultural seedbeds in Old Testament (e.g., premodern Judaic, Christian, and Islamic) law for example, on through both the modern and postmodern eras (see: “A Historical Overview of Economic Events“) proves especially revealing.

Yet, in tracing its hermeneutic path over time, one soon realizes the meaning associated with the term usury has varied significantly from its contextual origins. The truth of this is evidenced in the fact that for centuries leading up to the modern age, the Catholic Church under Canon Law virtually condemned usury as an abominable evil.[1] From this perspective then too, it’s fascinating to note the varying extent to which different societies throughout history have chosen to legitimize or otherwise sanction its use. In the same regard though, yet today, Islamic economic jurisprudence subsequently views the charging of interest as a form of riba, and on those grounds, positionally opposes its practice. [2] As a result, it’s disturbingly unconscionable, especially in view of Egypt’s revolution earlier this year, to blindly ignore how the West’s present centralized, debt-oriented, economic system, implemented globally towards the end of World War II, is perpetuating an ever-widening gap between the world’s richest and poorest, and in so doing, fueling tensions increasing the likelihood of social upheaval across vast geopolitical sectors.

Historical Background

This alliance between power, wealth, central banking, and government however, dates back at least to the early 17th century where it was first contrived and subsequently instated as an innate aspect of Western modernity. Beginning with formation of the Bank of Amsterdam in 1609 to help regulate “chaotic monetary conditions” at an onset of the Dutch Golden Age, central banking has played a surprisingly tacit, though nonetheless prodigious role effecting the rise and fall of world empires ever since.[3]

Ironically, again in reference to the commonly shared knowledge of human consciousness, a pronounced cycle of boom and bust has nonetheless underwritten this era of modern capitalism. Tulip mania in 1637, “considered the first recorded speculative bubble [4]has subsequently been viewed as an early indicator of an underlying “structural problem” which in Bernard Lietaer’s view, broaches the question as to whether there’s actually a “bug in the monetary system” possessing sufficient might to crash the entire “operating system of capitalism”.[5]

Not dissimilarly, John Locke’s philosophical influence in proffering time honored democratic ideals (see: Two Treatises of Government) tied to his personal friendship supporting William III’s ascension from the Dutch to British throne with the Glorious Revolution (1688) is also, closely associated with central banking’s establishment of the Bank of England in 1694. By way of illustrating, the extent to which modern science’s own development, particularly during the 17th and 18th centuries paralleled that of a centralized financial (i.e., monetary) system’s overall design and management.

Isaac Newton’s appointment to the Royal Mint in 1696 is likewise, intriguingly noteworthy. Similarly then, and due to Newton’s understanding of a universe “composed of basic building blocks—atoms having become the preferred explanation—held together, and their behavior regulated, by discernible laws” (e.g., laws of motion, gravity, light, thermodynamics, etc.), the province of subjective consciousness and values, pertaining especially to moral and ethical development over the last three hundred years, has largely been eschewed in relegation to the domain of religious doctrine. Thus, the material certainty generally associated with objective reality, in contrast, has subsequently been viewed as more tangible or real and as a result, afforded precedence over subjective experience (i.e., reality). This empirically based approach to knowledge then, has been utilized nonetheless as a “mechanistic and reductionist model that helped provide, within the realm of human society, the metaphysical base for the emergence of modern institutionalized systems of social order.”

“Implicit in such a view is the idea that nature is structured in relatively simple patterns of calculation that can be accurately identified and measured. Because of the presumption of certainty inherent in such a model, it has long been an article of faith that, given sufficient information, it is possible for human beings to predict the consequences of events in both our physical and social worlds.” Butler Shaffer, Boundaries of Order

Taking all this into consideration then, Butler Shaffer in Boundaries of Order: Private Property as a Social System, points to the importance of Locke’s writing in translating how, what were at that developmental juncture held as (nearly) Divine rights or principles of human experience, came to be incorporated within the working framework of modern government. Because personal property, in Locke’s appraisal, was such a focal component in moderating the balance of relational power between government and the individual however, consent of the governed was understood to be an almost sacred precept within the broader context.[6]

“As a result, many people have mistaken the force of arms for the consent of the people—·or,

anyway, have credited armed force with doing things that really only consent can do·—and have counted conquest as one of the sources of government.” John Locke from, Second Treatise on Government [underlining added] [7]

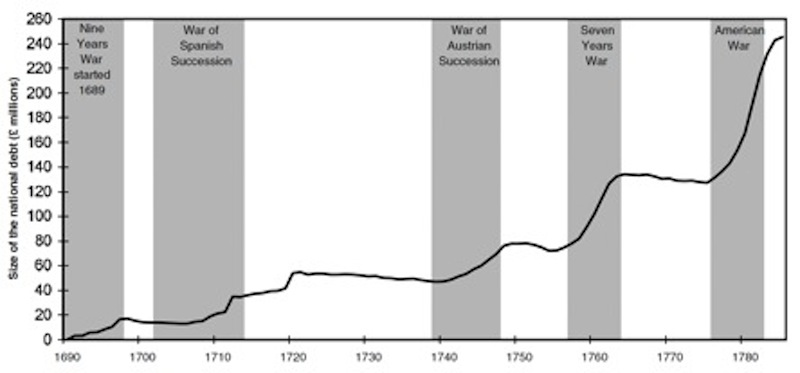

It’s for this reason though, that Figure 1 (also in, “An Integral Perspective” – Birth of a Modern Empire) has been included, in directing the reader’s attention to the means by which modern Western governments have abdicated fiscal propriety in centuries past and circumvented popular consent by instituting public debt in ways that have inextricably expanded empire. An early example of this soon followed the Bank of England’s origination where, by 1710, the “new system of credit” that had already “financed a costly war against Louis XIV” was “rapidly approaching the limits of its capacity.”

In this instance though, the solution for a faltering British economy would simply entail plying on “the public’s imagination of far-away colonial riches” in wooing would-be investors to exchange “ailing government bonds” for shares in a newly incorporated slave trading, South Sea Company. By transmigrating what had originated as public debt to the private sector however, “the Treasury was once again able to raise new funds to finance the war.” This approach that so shrewdly converted public obligation into private investment however, would also eventually lead to the South Sea Bubble, which, like Tulip mania, became one of the earliest financial crises of the modern era.[8]

In less than three decades from this juncture, Great Britain’s national debt had soared from “£75 million in 1754″ to “£133 million” by 1763 (see Figure 1), due primarily to waging simultaneous warfare across two continents and financing both the French and Indian and Seven Years War(s). Consequently, Parliament’s failed attempts to levy a Stamp Act against American colonists in 1765 served a loathsome admonition as to the power one nation’s will (Britain’s) could impose upon another’s destiny.[9]As a result, and with the exception of a relatively brief stint in which the United States’ newly forged government chartered central banking operations and passage of the Legal Tender Act of 1862 (see also National Bank Act) to provide Civil War monies, early American leadership observed hard learned lessons involving the printing and lending of money. Thus, and as a result, the newly created (U.S.) government would itself, forgo yielding to the installation of any comparable system for almost another hundred years.

The ethical resolve for following this course however, may be in large part attributable to the determinism of Adam Smith’s (1723-1790) influence as a social philosopher and teacher of moral philosophy. Coincidentally then, a key figure in the Scottish enlightenment, Smith is also “widely cited as the father of modern economics and capitalism“[10] and his Wealth of Nations, generally “considered to be the foundation of modern economic theory.”[11] Yet, and like other classical economists including Thomas Malthus and David Ricardo, it should be noted that Smith never utilized the phrase laissez-faire, meaning “an environment in which transactions between private parties are free from state intervention, including restrictive regulations, taxes, tariffs and enforced monopolies.”[12] By way of comparison however, the philosopher’s use of the term invisible hand in reference to “the self-regulating nature of the marketplace” is well known and “nearly always generalized beyond Smith’s original discussion of domestic versus foreign trade.” [13]

It’s especially telling in this regard then, that as a result of their own subjectivity to, and largely in rejection of the concept of taxation without representation, that the U.S. Constitution’s authors would adopt it with the express intent of assuring both sovereignty and autonomy for their newly formed nation, free from the exerted tyranny of foreign interests. Consequently, but by the same standard, it’s rather contemptuous that Western economics melding central banking, neoclassical economics, and neoliberalism/neoconservatism together, has in recent decades imposed itself on such a large cross section of the world in a manner so comparable to that of 18th century England.

The New World Economy

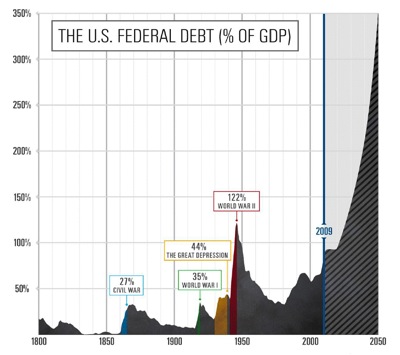

Figure 2 - "Comeback America: Addressing Federal and State Fiscal Sustainability Challenges" Nelson A Rockefeller Institute of Government

Nevertheless, and again in reference to “Appendix 1 – A Historical Overview of ‘Economic’ Events (from an Integral Perspective)“; following “the aftermath of economic Panic(s) in 1893 and again in 1907, a U.S. Congress” enacted the Aldrich-Vreeland Act in 1908.[14] Oddly, and even though a centrally organized group of bankers had launched a strategic assault against the interests of private citizens as evidenced by “The Bankers Manifesto of 1892,” [15]

the Aldrich-Vreeland Act nevertheless ushered the National Monetary Commission into existence, eventually leading to adoption of the Federal Reserve Act in 1913.[16]

Thus, the Federal Reserve System was established as an independent federal government agency, constituted by members appointed to the Federal Reserve Board. In retrospect though, the Federal Reserve Act’s creation as a central bank in the United States, appears to have functioned to some extent like a mathematical scalar in an entire sequence of indirectly, but similarly related events. Beginning with World War I (1914), followed by the Great Depression (1929), then Russia’s Great Purge (1936), and continuing through the Holocaust (1939), this ruinous phase of disaster would ultimately culminate in World War II (1939-1945). Tragically then, but in a period of just over three decades, a total of between 80 and almost 100 million lives were nonetheless eliminated from the face of the earth in a previously unimaginable wrecking of human carnage.

With this entire scope of history in mind though, it’s enthralling that the Atlantic Charter as issued in August of 1941 defining the Allied goals for a post-war world, would itself comprise an initial step in forging what H.G. Wells only the year before, had described in length as The New World Order (1940). Consequently then, and as the war drew to its end, “730 delegates from all 44 Allied nations,” gathering in Bretton Woods, New Hampshire the summer of 1944, initialized “a system of rules, institutions, and procedures to regulate” an international monetary nexus known as the Bretton Woods system.[17]

The underlying blueprint for this New World Order (politics) was subsequently founded on the creation of an International Monetary Fund (IMF) and the International Bank for Reconstruction and Development (IBRD); better known today as the World Bank Group. Over this same period of time, John Maynard Keynes (1883-1946) too, would assume a position at the forefront of economic affairs, initially in negotiating Germany’s reparations from World War I and later as a staunch advocate of “a world central bank” under the Bretton Woods system.[18]

Keynesian economics then, has subsequently asserted “that private sector decisions sometimes lead to inefficient macroeconomic outcomes and therefore advocates active policy responses by the public sector, including monetary policy actions by the central bank and fiscal policy actions by the government to stabilize output over the business cycle.”[19] Likewise, but due to the relative strength of the United States’ own economy in WWII’s aftermath, the Bretton Woods approach positioned the U.S. as a contributing partner of the Marshall Plan prior to enlisting that (same) stature within a “system of triangular trade.” As Figure 2 reflects though, while its function in this respect served to reinforce “the American role as the guarantor of stability” to the world, its prominence in this regard appears to have waned in almost direct relation to its military involvement in Vietnam.[20]

Consequently, but “(b)y the early 1970s, as the costs of the Vietnam War and increased domestic spending accelerated inflation”, a suspension of the Bretton Woods system by Richard Nixon in the wake of the first balance of payments deficit and trade deficit of the 20th century, came to be known as the Nixon Shock. His action subsequently imposed “a 90-day wage and price freeze, a 10 percent import surcharge, and, most importantly, “closed the gold window,” ending convertibility” to US dollars. [21]Ironically then, but as a result, a “fledgling management consultant” by the name of Bernard Lietaer, having published a “post-graduate thesis at MIT” in 1971 addressing the subject of floating exchanges, “suddenly found himself” at the center of “the financial world’s attention.”[22]

“American Psychosis – What happens to a society that cannot distinguish between reality and illusion?”

“The United States, locked in the kind of twilight disconnect that grips dying empires, is a country entranced by illusions. It spends its emotional and intellectual energy on the trivial and the absurd. It is captivated by the hollow stagecraft of celebrity culture as the walls crumble. This celebrity culture giddily licenses a dark voyeurism into other people’s humiliation, pain, weakness, and betrayal. Day after day, one lurid saga after another, whether it is Michael Jackson, Britney Spears, or John Edwards, enthralls the country … despite bank collapses, wars, mounting poverty or the criminality of its financial class.” Chris Hedges, American Psychosis.

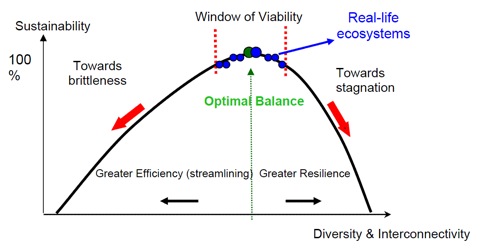

At his point however, yet for Lietaer, it’s the historical cycle of boom and bust referred to earlier, beginning with tulip mania in 1637 and carrying on through the Great Depression of 1929, combined with “more than 96 previous banking crises and 176 monetary crises” since the early 1970s, that have served to denote “structural problems” warranting “structural solutions.” As a result, his work with complex information and sustainable flow systems as reflected in Figure 3, has subsequently led to “scientific evidence that a structural fault is indeed involved in generating financial crashes,” which in turn, helps confirm “that nature does not select for maximum efficiency, but for a balance between the two opposing poles of efficiency and resilience.”[23]

Figure 3 - The "Window of Viability" from Lietaer's, Is Our Monetary Structure a Systemic Cause for Financial Instability?

Former U.S. Treasury analyst Richard C. Cook expressed a similar viewpoint in, We Hold These Truths: The Hope for Monetary Reform over the manner in which contemporary society is relinquishing individual freedom and control of their own lives “in a vain attempt to keep an artificial perpetual-debt-machine running.” Consequently then, but from his perspective, a great toll of the “needless suffering” associated with “war, poverty, the immigration crisis, outsourcing, bubbles, inflation and recessions” are (all) in varying degrees, attributable to the worldwide “debt-based monetary system” practiced as fractional reserve banking.

“The effects of current economic and monetary policies are starting to approach the level of genocide against large segments of society, if not in their intention, at least in their effects. Crime, health, and income statistics identify vast areas of both urban and rural environments as what have aptly been called ‘death zones.” Richard C. Cook [24]

Lest the reader believe Cook’s outlook is overstated, it attests nevertheless, to the dire reality of Figure 2’s projected impact in further undermining social order as we understand it. Similarly, the mutually shared project of globalization foisted by neoliberal/neoconservative ideologies alike, appears to have operated over recent decades much like Hitler’s employment of the National Socialist German Workers’ Party (Nazi Party) and his utilization of National Socialism in mobilizing a Third Reich.

“‘Civilization’ – not the institutional order – is in a critical condition, one brought on by the failure of our intellectual and spiritual immune systems to resist the virus of institutionalism. This crisis is not to be found in Washington, or Detroit, or on Wall Street, but in our ‘thinking’ about who we are as individuals and as members of society. As long as we revere the interests of organizations more highly than we do our own; as long as we continue to invest the lives of our children and grandchildren as resources for institutional consumption, this crisis will continue unto the disintegration of civilization itself.” Butler Shaffer from, “The Establishment in Crisis” – some punctuation substituted for italics in original.[25]

If anyone questions the imputation of my analogy to Fascism as illustrating the extent to which the menace of corporate

statism has permeated everyday culture and entrenched itself within the social disciplines of health care, education, economics or finance, I’d ardently invite contrasting those views to my own experience as I’ve recounted it in, A Case of Willful Neglect . My point in sharing this bit of personal history is simply to convey a firsthand account of what must be occurring to at least thousands like myself, all playing out in a devastating drama of human relations between family and friends ensnared within Mammon’s unholy grasp. Consequently, while we’ve largely disregarded the atrocities of a U.S. military presence in Iraq having in its own way contributed to the orphaning of “nearly half of the country’s children” virtually the same approaches to power and control are being exerted against the United States’ own domestic population. [26]

Resultantly, a monolithic social system continues in waging tyrannous assaults on marginalized members of its citizenry who are rather routinely, demonized, criminalized, or pathologized in justifying otherwise lawless violations of their person and property. Nowhere are these abuses more prevalent than, as I’ve observed from personal experience, the systemic extortion of child support from already disadvantaged, homeless fathers subjected to the brutish enforcement of an Orwellian societal order. From my perspective it has the effect of alienating and separating fathers from their children, similar to the historical slave trade, by exerting manipulative control over marginalized working and lower class fathers through what appears to many as the systemic extortion of child support. Nevertheless, but in entertaining prospects of navigating this future frontier teetering on the threshold between societal emergence and apocalypse however, Butler Shaffer elaborates:

“The pyramidal model—born of mechanistic and reductionist premises that no longer explain the interconnected nature of complex systems—is in need of replacement. A candidate for a paradigmatic change may be found in the interplay between “chaos” theory and complexity, on the one hand, and what I shall call a “holographic” model of order, wherein vertical structures are replaced by horizontal networks.” Butler Shaffer from, Boundaries of Order[27]

Adopting an Integral Approach

“In a period of ideological turmoil, environmental crisis, and economic meltdown; although world affairs are casting an ominous shadow of historical implication on an approaching horizon, many are cultivating ingenious new perspectives transcending the prior bounds of intractable dogma and staid orthodoxy. Illuminated by recent advances in digital, multimedia and communication technologies, nascent dimensions of integral thought are affording members of an emerging global society (e.g. ‘polity’) unique opportunities to transform the very course of human destiny.” from “An Integral Perspective: or Prophetic Peek at Apocalypse? – updated draft”.[28]

Stirred “by the urgency of our times,” Jennifer Gidley in, “The Evolution of Consciousness as a Planetary Imperative: An Integration of Integral Views,” explains, “(w) e live in critical times —times of apparently human-created complexities, challenges, and unprecedented change. In all the major domains of our lives the seams are beginning to fray.” Citing findings surrounding ‘Environmentally’, ‘Economically’, and ‘Psycho-socially’ related concerns, she adds, “(s)everal contemporary ecologists, educators, philosophers and scientists point to an epistemological crisis—or crisis of consciousness —at the heart of our planetary dilemma.”

Consequently, but where Gidley’s focus revolves primarily around the evolution of consciousness, her study represents a methodological examination of Integral views involving the work of Jean Gebser, Rudolf Steiner, and Ken Wilber. Gidley further notes that while the evolution of consciousness “has become a central theme in much of integral theory,” amongst the “leading integral theorists, such as Wilber and László,” a certain amount of contentious rivalry appears to distinguish their respective views on an Integral Theory of Everything (TOE).

“This paper foregrounds the ‘evolution of consciousness’ as a planetary imperative if we are to survive and thrive as a species on our earthly home. The notion that human consciousness ‘has’ evolved is a largely undisputed claim. However, the notion that human consciousness ‘is currently evolving’, in such a way that we can ‘consciously participate’ in this process, is an emergent theme in academic research.” Jennifer Gidley from, The Evolution of Consciousness as a Planetary Imperative – some punctuation substituted for italics in original.[29]

Subsequently then, and over the last twenty years, a radically new theoretical framework for organizing the world and its activities has been moving to the forefront of a discourse emerging from the theoretical psychology and philosophy of Ken Wilber. Otherwise known as Integral Theory, it represents “a body of work that has evolved in phases from a transpersonal psychology synthesizing various Western and non-Western understandings of consciousness”.[30]

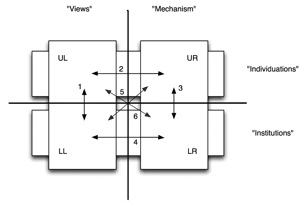

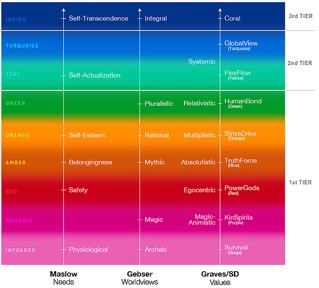

While Integral thought or theory can be readily associated with the contribution of Wilber’s efforts, Integral Spirituality (or Philosophy) is similarly, but more widely equated with additional thinkers including, Sri Aurobindo, Don Beck, Jean Gebser, (and) Robert Kegan [31] Consequently, while it’s beyond the intended scope of this paper to present a complete overview of the maturation of ‘Integral’ thought to this juncture, Ken Wilber has nonetheless identified a “vertical component clash” as the “single greatest problem facing the world” in its impact effecting the ‘intentional’ (Upper Left – UL) and ‘cultural’ (Lower Left – LL) realms of existence (see Figure 4).

Pointing to the dominance of modern disciplines (i.e. Economics, Education, Medicine, etc.) founded over the last four hundred years on empirical orientations arising from the Scientific Enlightenment, he notes traditional Religion’s seeming failure to nurture higher stages of spiritual intelligence (or ultimate concern) to any significant extent beyond Fowler’s Stage 3, or Gebser’s mythical, levels of respective development.[32] Similarly, it’s important to note also that a common injunction running through much of Wilber’s writing in this regard is the term exemplar, particularly as used in reference to knowledge emanating from the wisdom traditions in general, and contemplative practice perhaps, more specifically.

For these reasons too, it’s especially notable that scientists like Stuart Kauffman (“Towards a Post Reductionist Science“) express sentiments regarding the pertinence of expanding scientific thought and inquiry beyond the limits of reductionism so disconcertingly evident in most disciplines. Subsequently, but in regards to Integral Theory, the prospect of actually doing this implies the development of transdisciplinary methods and applications across an entire spectrum of human endeavor including but not limited to Art, Ecology, Economics, Leadership, Politics, and Psychology.

Bridging Integral Leadership

Because the foregoing content makes a strong argument for initiating ‘systemic transformation’, from a standpoint of practical implementation, one might ask, ‘What practical steps might be taken in adopting Integral frameworks within our own communities?’ By way of addressing this question, Russ Volckmann of the Integral Leadership Review in a recent interview with Ken Wilber entitled, “The State of Integral”, discussed the extent to which Integral leadership entails “building bridges from first– to second-tier” levels of development (see Figure 5).

“The majority of people that are members of our organizations are probably first-tier in their development. Each of them sees integral according to their own values, whether they’re orange rational-scientific values or green pluralistic-post-modern values . . . so they’re seeing the model through their own eyes and according to their own views.” Ken Wilber from, “A Conversation with Ken Wilber” [33]

Consequently, but in adopting approaches capable of moving others towards Second-Tier levels of development, Terry Patten has envisioned the emergence of “a new ecology of pedagogical roles” including “integral evolutionary coaches, mentors, and teachers” all, practicing at the “leading-edge (of) spirituality”. He’s subsequently detailed qualifications enumerating these respective functions where a coach’s practice (and life- style) for example, would reflect “holistic hygiene, including a conscious diet, exercise regime, conscious relationship to sleep, compe tent self-management practices, and regular study and growth of perspective.”[34]

Figure 5. An Overview of Stages of Consciousness: Climate, Culture, and Consciousness: Growing Green

Similarly, Marilyn Hamilton at Integral City too, has formulated guidelines representing a skill-set of attributes ranging from Quality of Life (QOL) Citizen-Leaders to Practitioners, Catalysts, and Meshworkers (also see Figure 5 – Developmental Levels and Worldviews (LL)”Integral City: Practitioners, Catalysts, MeshworkersProfiles“). Consequently then, and in further adopting this organizational approach, Hamilton has subsequently assembled a “Team of Advisors and Meshworkers from around the world” in coalescing “power, authority and influence for the well-being of Gaia’s Integral Cities.”[35]

Pioneering an Integral Future

Expounding on the overall theme of this project however, and in summation of the article’s content to this point, the implication of Figure 2’s impact on any kind of sustainable future, should be cause for soul searching, self-assessment. In the very simplest of terms, yet over at least the last two centuries, the ratio of accumulated debt to gross domestic product (GDP) clearly indicates that without a transformational redirection occurring in the next 10 to 15 years, there is every likelihood the United States’ socioeconomic destiny could entail a catastrophic disruption on a level comparable to that of previous world wars.

Integral Economics

“The past few months have been a financial rollercoaster for the world in general and the United States in particular. Never has the topic of integral economics seemed so urgent as we watch the potential collapse of capitalism as we know it. As a global civilization, our national markets are inextricably linked, for better or worse, and business as usual is likely not going to continue. Between the collapse of the U.S. housing market, the failures in the banking industry, and now the potential bankruptcy of the American automobile industry, we are desperately in need of new visions of economics and new next steps.” Sean Esbjörn-Hargens [36]

The shortcomings of neoclassical economics to which this paper has already alluded is of course, not a new theme in the field of related academics. Ha-Joon Chang in “Breaking the mould” for example, refers to neo-liberalism as “an unholy alliance between neoclassical economics and the Austrian-Libertarian political philosophy” claiming that “despite its pretence of intellectual coherence and clear-cut messages” it protracts itself only through “intellectual contortion and political compromise.”

Chang further describes how neoclassical economics has effectively positioned itself to exercise influence and control over an entire socioeconomic system, separate and apart from the moderating power of democratic (e.g., political) oversight, and largely beyond the scope of public ‘consent’ or input. As a result, he’s subsequently concluded that “overcoming the limitations of the neo-liberal discourse” involving the role of the state can be accomplished only “by breaking this mould and developing an alternative framework” bringing “institutions and politics to its analytical core.”[37]

Fatefully enough, but beginning more than two years ago, the Journal of Integral Theory and Practice introduced the work of two economists both, in their own way, contributing to the articulation of an integral eco-nosmics. In “Building an Integral Economic Science: Opportun-ities and Challenges“, Christian Arnsperger notes that “today’s economics is, even at its most cutting-edge frontier, an exclu- sively Right-Hand endeavor,” Arnsperger’s – ‘Interconnections in the AQAL Model‘ one that quite “intentionally

and systematically aims to over- look the “interior” dimensions of economic phenomena”. In other words, but as a sociopolitical discipline, ‘modern economics’ as we currently know it, deliberately ignores the realms of psychological'(UL quadrant) and cultural (LL quadrant) value.

“In such a context, it should be noted, “society” is first and foremost—and often exclusively—seen

as the system of governance schemes designed to order a potentially disorderly set of individuals

scrambling for material rewards. Society, in such a view, is something that is designed by people—but mainly and even exclusively by those people who are “in charge” of looking after the whole and to keep it in a measure of internal order.” Christian Arnsperger [38]

Arnsperger thus depicts the social science we call economics as a one size fits all, “top-down” managerial approach that, for the sake of its own convenience, tends “to view the population of agents as a more or less homogeneous statistical whole.” Consequently then, and operating from a materialistic bias driven by capitalistic and growth based assumptions, this same system, to society’s detriment, incessantly enlists a mindless set of pseudo-incentives often aimed in their appeal towards rudimentary, more is better mentalities. As a result, and according to Arnsperger, this has subsequently resulted in its devising “macro– or micro-policies—to be implemented on us—subject to the “working assumption” that our interiors do not really matter.”

As a meta-discipline methodology though, Arnsperger in contrast, envisions an integral economics with the capability to instead, facilitate our “fullest human potential.” Adopting a practice in the same manner that “Wilber’s “post-metaphysical” stance” draws from an “empirical observation of the most highly realized exemplars coming from each culture, religion, or spirituality”, he further envisions a four quadrant paradigm facilitating the development of “experientially reproducible life trajectories (states evolving into traits as the individual evolves through necessary stages).”

Similarly, Arnsperger also cites the work of those like Amartya Sen in respect to Nobel laureates who, no longer beholden to the provision of mainstream economics for career and livelihood, are actually expanding economic thought beyond pervasive, outdated obstacles. As an example, Douglas North “has insisted heavily on the crucial role played in economic evolution by agents’ intentionality—not just in the passive sense of being aware of the world around them, but in the active sense of being aware of their own awareness.”

“Ideally, integral economics should be an agent-based, complex-systems approach in which agents have evolutionary states of consciousness and which, consequently, evolves not only through positive and negative feedbacks from system to components but also—and mainly—through the agents’ own existential and critical reflection on what a meaningful, human potential–enhancing economic life could be.” Christian Arnsperger from, “Building an Integral Economic Science”

Also in this same issue of the Journal of Integral Theory and Practice, Kevin Bowman published an article entitled, “Integral Neoclassical Economic Growth.”[39] Where Sean Esbjörn-Hargens has conceptualized Integral Theory as “an all-inclusive framework for the 21st century“[40]and subsequently translated it in terms of an Integral ecology, Bowman reflects similar aspirations to legitimize an Integral political economy. Consequently then, but applying Wilber’s insights regarding the pre/trans fallacy in identifying it as a “immature/mature fallacy” within economics, Bowman asserts that “(o)vercoming the fallacy contributes to a desire to integrate neoclassical and heterodox schools of economics.”[41]

Integral Sustainable Development

“The role of the leader is to guide, inspire and to provide clarity in navigating the path ahead. Leadership vision is the ability to see what others do not see and then to show the way. In performing this role our leaders act as custodians of our future. Sustainability defines a path which enables this future to be realized. Navigating the path to sustainability is a leaders’ role.” William Varey [42]

According to Wikipedia, an “oft-quoted definition of sustainable development” is one originating with the Brundtland Commission in a document entitled, “Our Common Future” which refers to it as “development that meets the needs of the present without compromising the ability of future generations to meet their own needs.”[43]

Consequently I suppose, the economic decline occurring in the last five or six years is made all the more deplorable for me knowing that, beginning in September of 2005, former U.S. Comptroller General David M. Walker launched a nationwide Fiscal Wake-up Tour in efforts to tell “civic groups, university forums and newspaper editorial boards that the U.S. [had] spent, promised, and borrowed itself into such a deep hole it [would] be unable to climb out if it [didn’t] act now” (see Figure 2).

Furthermore, when asked if he knew of politicians capable of providing sufficient leadership to address this quandary, Walker responded, “I don’t know politicians that like to raise taxes. I don’t know politicians that like to cut spending, but I think what we have to recognize is this is not just about numbers. We are mortgaging the future of our children and grandchildren at record rates, and that is not only an issue of fiscal irresponsibility, it’s an issue of immorality” [44]

Thus in contrast, yet from an Integral perspective, if the definition of sustainability is to mean anything at all, it will embrace not only ‘all quadrants and levels’ (AQAL) of Wilber’s model, but necessarily include relevant lines, streams, intelligences, its levels or stages, its states, and its types as well. Taking steps in this direction, Bernard Lietaer’s work certainly exudes an appreciation for the fact that an economy actually functions more as a living ecosystem, with its component members interrelating in accordance with laws of nature affecting the exchange of energy and/or information (e.g. biomass, currency, etc.), than does it a ‘social science‘–at least as we currently know it.[45]

However, if mankind as a whole is to continue evolving and to transcend the prospect of otherwise becoming little more than a ‘food chain’ comprised of homo economicus, it will need to begin embracing revolutionary new outlooks almost immediately. As Lietaer has already shown too, this will mean further developing capacities that allow us to venture beyond the limits and ignorance of a blind reliance on such simplistic notions as economies of scale and instead, work towards becoming living testaments that life’s complexity is most vibrant and robust when efficiency is sustained in harmonious balance to diversity and interconnectivity.

Also, while open to virtually everyone without discrimination or condition, connection with this process is likely to be realized primarily (solely?) by individuals adopting contemplative or meditative practice as a central operating system within the broader context of an Integral (e.g., AQAL) discipline. At the community level though, and as noted by Butler Shaffer, practical navigation of the circumstances described herein similarly necessitate reevaluating our understanding and observance of boundaries in so far as they involve (primarily) interrelations between people, property, and its sustainable ownership (or stewardship).

Within a system whose ‘terms’ of interrelationship are however, essentially predicated on, and to some extent dictated by, a monopolization of the very commodity used to facilitate it, current technologies now afford us the means to at least loosen the bonds we’ve so insidiously placed upon ourselves. Yet, this is precisely the reason both Bernard Lietaer and Richard Cook have been such strong and outspoken advocates of complementary currency and why the genius of their insight validates a multitude of alternative paths to the positivist beliefs we’ve so unwittingly subscribed.

Works Cited

[1] McConnell, Brian. “Appendix 1 – A Historical Overview of ‘Economic’ Events (from an Integral Perspective).” (2011): in “An Integral Perspective: or Prophetic Peek at Apocalypse?“, (February 2011): 20-23. Web. 15 Mar. 2011.

[2] Wikipedia contributors. “Riba.” Wikipedia, The Free Encyclopedia. Wikipedia, The Free Encyclopedia, (28 Dec. 2010): Web. 17 Mar. 2011.

[3] Quinn, Stephen, and William Roberds. “An Economic Explanation of the Early Bank of Amsterdam, Debasement, Bills of Exchange, and the Emergence of the First Central Bank.” (2006): FRB of Atlanta Working Paper No. 2006-13, (September 2006). Web. 19 Mar. 2011 <http://ssrn.com/abstract=934871>.

[4] Wikipedia contributors. “Tulip mania.” Wikipedia, The Free Encyclopedia. Wikipedia, The Free Encyclopedia, (24 Feb. 2011). Web. 21 Mar. 2011.

[5] Lietaer, Bernard. “Is Our Monetary Structure a Systemic Cause for Financial Instability? – Evidence and Remedies from Nature.” (2010): From the Journal of Futures Studies, Vol. 14, #3, (April 2010) Web. 20 Mar. 2011 <http://www.lietaer.com/images/Journal_Future_Studies_final.pdf>.

[6] Shaffer, Butler. Boundaries of Order: Private Property as a Social System. (2009): Auburn, Mises Institute, mises.org/books. Web. 31 Mar. 2011 <http://mises.org/books/boundaries.pdf>.

[7] Locke, John. “Second Treatise of Government.” (1689): earlymoderntexts.com. Ed. Jonathan Bennett. (March 2008). Web. 28 Mar. 2011 <http://www.earlymoderntexts.com/pdf/locke2tr.pdf>.

[8] Wennerlind, Carl. “The South Sea Company and the Restoration of Credit: Slavery, Public Opinion, and Party Politics” (2007): From a talk at Yale University. Web. 31 Mar. 2011.

[9] The Seven Years War to the American Revolution.” (2011): Tax History Museum: 1756-1776.

www.taxanalysts.com. Copyright Tax Analysts (2011). Web. 15 Apr. 2011

<http://www.taxanalysts.com/www/website.nsf/Web/THM1756?OpenDocument>.

[10] Wikipedia contributors. “Adam Smith.” Wikipedia, The Free Encyclopedia. Wikipedia, The Free Encyclopedia, (30 Mar. 2011). Web. 16 Apr. 2011.

[11] Wikipedia contributors. “The Wealth of Nations.” Wikipedia, The Free Encyclopedia. Wikipedia, The Free Encyclopedia, (15 Apr. 2011). Web. 16 Apr. 2011.

[12] Wikipedia contributors. “Laissez-faire.” Wikipedia, The Free Encyclopedia. Wikipedia, The Free Encyclopedia, (8 Apr. 2011). Web. 19 Apr. 2011.

[13] Wikipedia contributors. “Invisible hand.” Wikipedia, The Free Encyclopedia. Wikipedia, The Free Encyclopedia, (17 Apr. 2011). Web. 20 Apr. 2011.

[14] McConnell, Brian. “Appendix 1 – A Historical Overview of ‘Economic’ Events (from an Integral Perspective).” (2011): in “An Integral Perspective: or Prophetic Peek at Apocalypse?.” (February 2011): 20-23. Web. 19 Apr. 2011.

[15] Louis Even, “An example of banking philosophy.” (1941): “Michael” Journal (2003). Web. 25 Apr. 2011.

[16] Wikipedia contributors. “Aldrich–Vreeland Act.” Wikipedia, The Free Encyclopedia. Wikipedia, The Free Encyclopedia, (11 Mar. 2011). Web. 19 Apr. 2011.

[17] Wikipedia contributors. “Bretton Woods system.” Wikipedia, The Free Encyclopedia. Wikipedia, The Free Encyclopedia, (16 Apr. 2011). Web. 25 Apr. 2011.

[18] Wikipedia contributors. “John Maynard Keynes.” Wikipedia, The Free Encyclopedia. Wikipedia, The Free Encyclopedia, (26 Apr. 2011). Web. 26 Apr. 2011.

[19] Wikipedia contributors. “Keynesian economics.” Wikipedia, The Free Encyclopedia. Wikipedia, The Free Encyclopedia, (26 Apr. 2011). Web. 26 Apr. 2011.

[20] Wikipedia contributors. “Bretton Woods system.” Wikipedia, The Free Encyclopedia. Wikipedia, The Free Encyclopedia, (16 Apr. 2011). Web. 26 Apr. 2011.

[21] Wikipedia contributors. “Nixon Shock.” Wikipedia, The Free Encyclopedia. Wikipedia, The Free Encyclopedia, (24 Apr. 2011). Web. 26 Apr. 2011.

[22]Wikipedia contributors. “Bernard Lietaer.” Wikipedia, The Free Encyclopedia. Wikipedia, The Free Encyclopedia, (13 Apr. 2011). Web. 27 Apr. 2011.

[23] Lietaer, Bernard, Robert Ulanowicz, Sally Goerner, and Nadia McLaren. “Is Our Monetary Structure a Systemic Cause for Financial Instability? – Evidence and Remedies from Nature.” (2010): From the Journal of Futures Studies, (April 2010) Vol. 14, #3. Web. 20 Mar. 2011 <http://www.lietaer.com/images/Journal_Future_Studies_final.pdf>.

[24] Walton, Jamie. “A Review of We Hold These Truths: The Hope for Monetary Reform by Richard C. Cook.” Rev. of We Hold These Truths, by Richard C. Cook. American Monetary Institution (AMI), (15 Oct. 2010). Web. 20 Apr. 2011, (127).

[25] Shaffer, Butler. “The Establishment in Crisis.” (2010): LewRockwell.com. (January 2010). Web. 20 Apr. 2011 <http://www.lewrockwell.com/shaffer/shaffer203.html>.

[26] Wikipedia contributors. “Iraq War.” Wikipedia, The Free Encyclopedia. Wikipedia, The Free Encyclopedia, (19 Apr. 2011). Web. 21 Apr. 2011.

[27] Shaffer, Butler. Boundaries of Order: Private Property as a Social System. Auburn: Mises Institute, (2009): mises.org/books. Web. 31 Mar. 2011 <http://mises.org/books/boundaries.pdf

[28] McConnell, Brian. “An Integral Perspective: or Prophetic Peek at Apocalypse? – updated draft2.” (February 2011): Web. 20 Apr. 2011<https://docs.google.com/viewer?a=v&pid=explorer&chrome=true&srcid=0B7qaTBjzI8w_NzQ3NGNmN2ItMGI5Zi00ZDlkLTk4YzctZTFlNzg0NTgwOGE2&hl=en>.

[29] Gidley, Jennifer. “The Evolution of Consciousness as a Planetary Imperative: An Integration of Integral Views.” (2007): In Integral Review, Issue 5, (December 2007). Web. 20 Mar. 2011.

[30] Wikipedia contributors. “Integral Theory.” Wikipedia, The Free Encyclopedia. Wikipedia, The Free Encyclopedia, (20 Apr. 2011). Web. 21 Apr. 2011.

[31]Wikipedia contributors. “Integral (spirituality).” Wikipedia, The Free Encyclopedia. Wikipedia, The Free Encyclopedia, (4 Mar. 2011). Web. 21 Apr. 2011.

[32] Wilber, Ken. Integral spirituality: A startling new role for religion in the modern and postmodern world. Boston: Shambhala Publications, Inc. 2006. Print.

[33] Volckmann, Russ. “Fresh Perspective – The State of Integral: A Conversation with Ken Wilber.” (2010): Integral Leadership Review, Volume X, No. 5, (October 2010). Web. 28 Feb. 2011.

<http://www.archive-ilr.com/archives-2010/2010-10/ILRkenruss.pdf>

[34] Patten, Terry. “Toward the Emergence of Integral Evolutionary Spiritual Culture.” (2010): In a presentation to the Integral Theory in Action Conference: “Enacting an Integral Future”, (July 2010). Web. 27 Apr. 2011. <http://www.integralspiritualpractice.com/files/ITC-IESC-Patten-Final_0.pdf>.

[35] “About Us (Advisory Board).” (2010): Integral City. www.integralcity.com. Copyright (2010). Web. 30 Apr. 2011 <http://www.integralcity.com/about-us/advisory-board.html>.

[36] Esbjörn-Hargens, Sean. “Editorial Introduction.” (2008): Journal of Integral Theory and Practice, Volume 3, No. 4 – Winter 2008. Copyright, Integral Institute (2008). Web. 2 May 2011. <http://aqaljournal.integralinstitute.org/Pdf/Vol3_No4_Final.pdf>.

[37] Chang, Ha-Joon. “Breaking the Mould: An Institutionalist Political Economy Alternative to the Neoliberal Theory of the Market and the State.” (2001): United Nations Research Institute for Social Development. Social Policy and Development Programme Paper Number 6, (May 2001). Web. 2 May 2011.

[38] Arnsperger, Christian. “Building an Integral Economic Science: Opportunities and Challenges.” (2008): Journal of Integral Theory and Practice, Volume 3, No. 4 – Winter 2008. Copyright, Integral Institute (2008). Web. 4 May 2011.

[39] Bowman, Kevin. “Integral Neoclassical Economic Growth.” (2008): Journal of Integral Theory and Practice, Volume 3, No. 4 – Winter 2008. Copyright, Integral Institute (2008). Web. 4 May 2011.

[40] Esbjörn-Hargens, Sean. “An Overview of Integral Theory: An All-Inclusive Framework for the 21st Century.” (2009): Integral Institute, Resource Paper No. 1, (March 2009).

[41] Bowman, Kevin. “Holarchically Embedding Integral Political Economy.” (2010): Submitted to the Journal of Integral Theory and Practice (January 2010). Web. 4 May 2011.

[42] Varey, William. (2004): “Transforming Sustainability: An Integral Leader’s Framework.” Presentation. 6th Spirituality Leadership and Management Conference. Fremantle, Western Australia (February 2004). Web. 5 May 2011.

[43] Wikipedia contributors. “Our Common Future.” Wikipedia, The Free Encyclopedia. Wikipedia, The Free Encyclopedia, (23 Mar. 2011). Web. 4 May. 2011.

[44] U.S. Heading For Financial Trouble?.” 60 Minutes segment. Producer Andy Court. CBS News, (8 July 2007). Web. 19 Apr. 2011. <http://www.cbsnews.com/stories/2007/03/01/60minutes/main2528226.shtml?tag=contentMain;contentBody>

[45] Ulanowicz, Robert, Sally Goerner, Bernard Lietaer, and Rocio Gomez. “Quantifying sustainability: Resilience, efficiency and the return of information theory.” (2009): Ecological Complexity, Volume 6, Issue 1 (March 2009). Web. 5 May 2011.

About the Author

Brian McConnell has worked with the underpinnings of Integral thought and theory, primarily in the fields of education and psychology, since first introduced to Ken Wilber’s, Eye to Eye in 1997. His background in meditative practice stems from an introduction to, and study of Theravada Buddhism with Ajaan Thanisarro Bhikkhu. Having worked with a diverse set of popular subcultures over this same period, learning and leadership are dimensions of particular interest to him in respect to Integral Economics. Brian presently serves as Director for Group Epignosis, a community of learner/collaborators in Roanoke, Virginia and is affiliated with the Integral Research Center as a Researcher/Practitioner in Integral Sustainable Development.